Hi traders, we closed today another week of trading, and it’s been another amazing week of profits! If you’d like to follow our signals, please join our Telegram channel—it’s all free!

Today, let’s dive into the Head and Shoulder pattern, one of my favorites, and one that usually never fails. It’s also one of the easiest patterns to spot.

Understanding Head and Shoulders Patterns

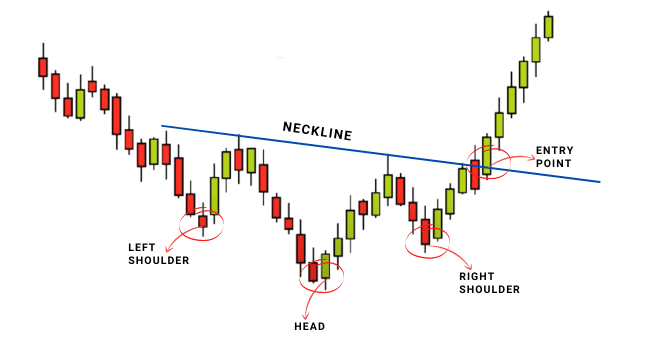

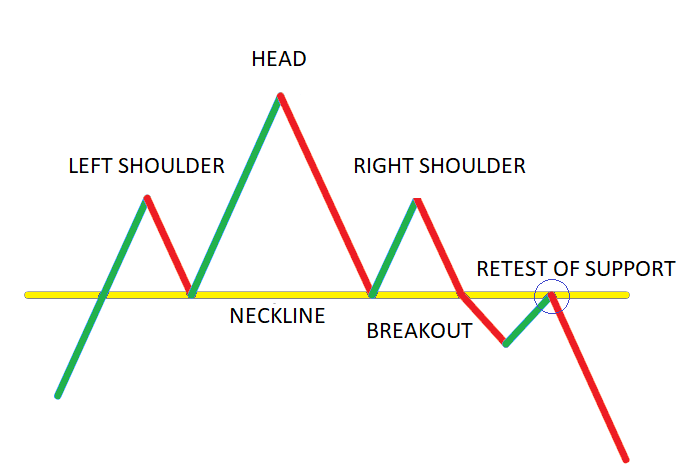

A head and shoulders pattern is a classic trend reversal formation characterized by three peaks: a peak (shoulder), followed by a higher peak (head), and then another lower peak (shoulder). Connecting the lowest points of the two troughs forms a “neckline.” The slope of this line, whether upward or downward, often dictates the reliability of the signal.

Identifying the Pattern

Visualizing the pattern is crucial. In a head and shoulders setup, the second peak constitutes the head, towering above the two shoulders. To trade this pattern effectively, an entry order is typically placed below the neckline, with the target calculated by measuring the distance from the head to the neckline. This measurement often indicates the potential price movement post-breakout.

Now, let’s turn the pattern upside down! The inverse head and shoulders pattern, as the name suggests, is a mirror image of its counterpart. Instead of peaks, it features valleys: a valley (shoulder), followed by a lower valley (head), and then another higher valley (shoulder). Occurring after prolonged downward trends, this pattern indicates potential reversals.

Like its counterpart, the inverse head and shoulders pattern demands attention. A long entry order is typically placed above the neckline, with target calculations mirroring those of the traditional pattern. Once the neckline is breached, a satisfying upward movement often follows.

Understanding Retests

When trading the head and shoulders pattern, it’s crucial to keep in mind that market dynamics can occasionally lead to retests of support levels and necklines. While the pattern typically signals a reversal, it’s not uncommon for price action to revisit these key levels before continuing its anticipated trajectory. These retests serve as critical moments for traders, offering opportunities to reassess their positions and confirm the validity of the pattern. Understanding this aspect of the head and shoulders formation helps traders navigate the market with patience and confidence, ensuring they’re prepared for all possible outcomes.

Mastering head and shoulders patterns can be a game-changer in your trading journey. So, next time you spot these formations on your charts, remember to seize the opportunity wisely!

by Vanessa Vasilache

Leave a comment